UX Projects

PNC Bank Financial Education Course

Redesigned the user experience of the Foundations of Money Management course for potential customers to address several pain points by adhering to WCAG 2.0 Accessibility standards, implementing a mobile-first responsive design, and adjusting the information architecture to reflect current financial advice and trends.

Background: In order to qualify for a Foundation Checking account, users were to successfully complete this course with an 80% correct rate and provide identification details prior to visiting a branch.

Users: Underbanked individuals who either do not have a bank account or who’ve had difficulties maintaining good standing with past bank accounts and would now like to open a debit account with PNC Bank, despite having feelings of overwhelm and/or hesitancy toward financial institutions.

Problems: 1. Course was only functional on a desktop computer. 2. Course did not follow accessible design standards. 3. Course content did not reflect current banking best practice and advice.

Feedback: 1. Research showed that underbanked individuals were more likely to access the internet via smartphones than desktops. 2. Individuals who had visual impairments had issues detecting CTAs, modules and test questions. 3. Financial professionals noted that the current content was not representative of current financial advice (2019-2021).

How would we redesign the course so it was better fit for the intended audience to access and promote course content integration into their financial lives moving forward?

Solutions: Redesign the course with the users’ mindset, needs and goals at the forefront through implementing a mobile-first responsive design, meeting WCAG 2.0 Accessibility standards, and crafting accurate, relatable and interactive content to solidify financial understanding.

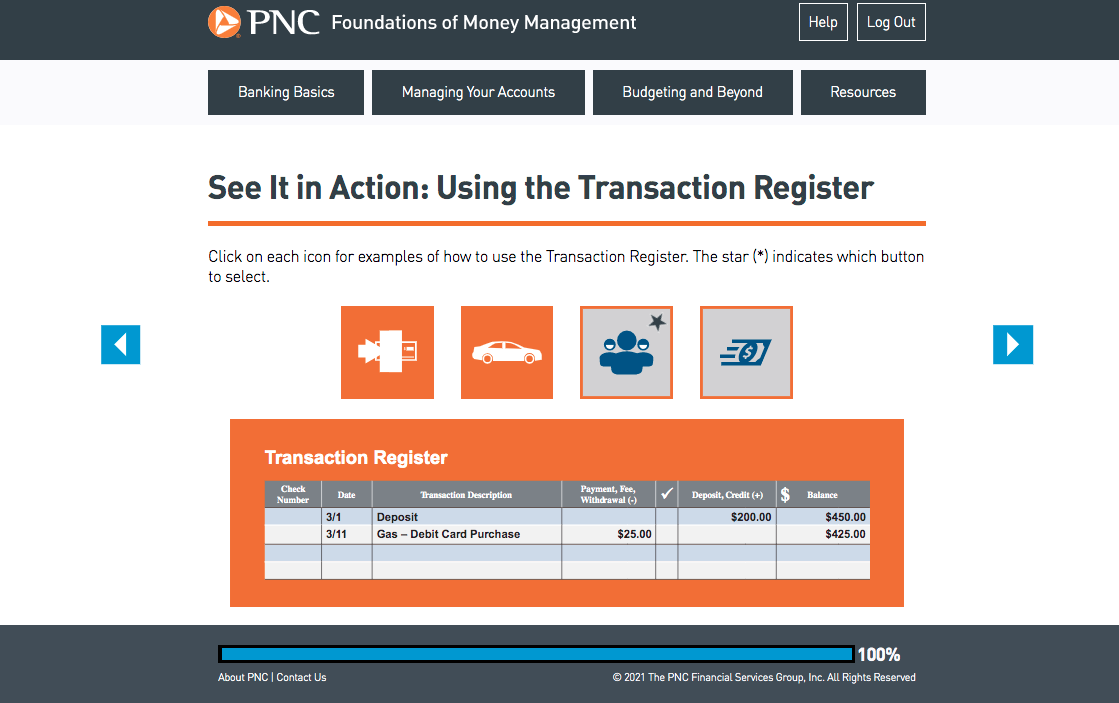

Other Considerations: To partner with users who have negative feelings toward financial intuitions, we focused on interactive activities to model the use of the downloadable tools to set them up for success. Additionally, we integrated periodic “knowledge check” questions to solidly learning through reflection and recall.

The site was not available in Spanish which we felt would be disparate treatment to continue not serving the Spanish-speaking community. We developed a Spanish language version of the course with culturally-relevant imagery and visuals.

Timeline: June 2019-March 2021

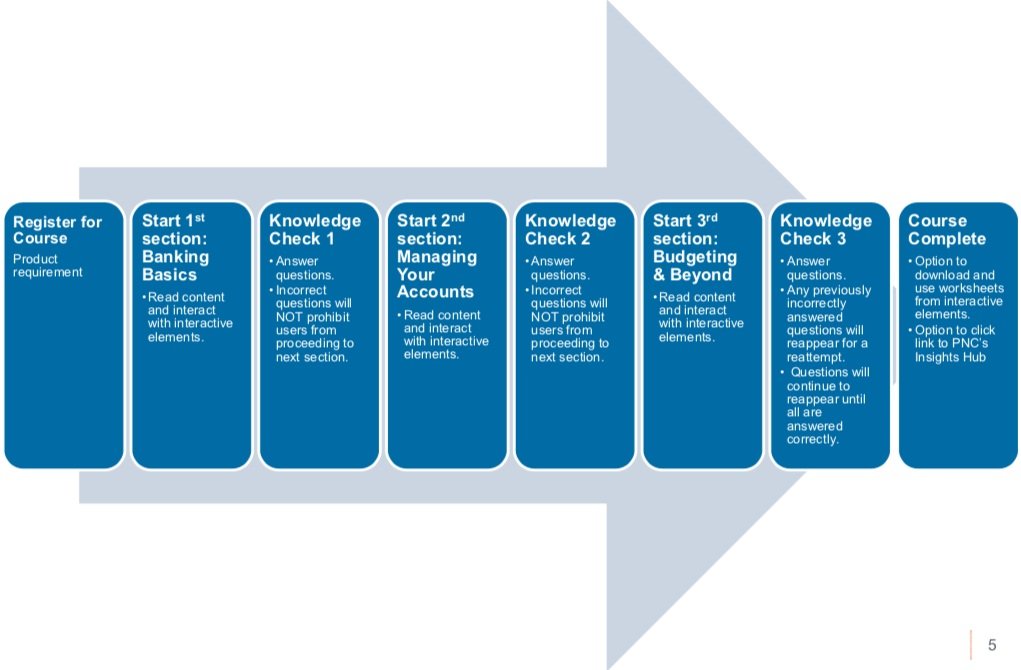

The course followed a linear user flow where even wrong answers to Knowledge Checks were not a roadblock for course progression. Since users were required to meet an 80% correct status to qualify for the account, incorrect questions were revisited at the end with consistent opportunities to revisit sections to solidify learning until 80% correct was reached.

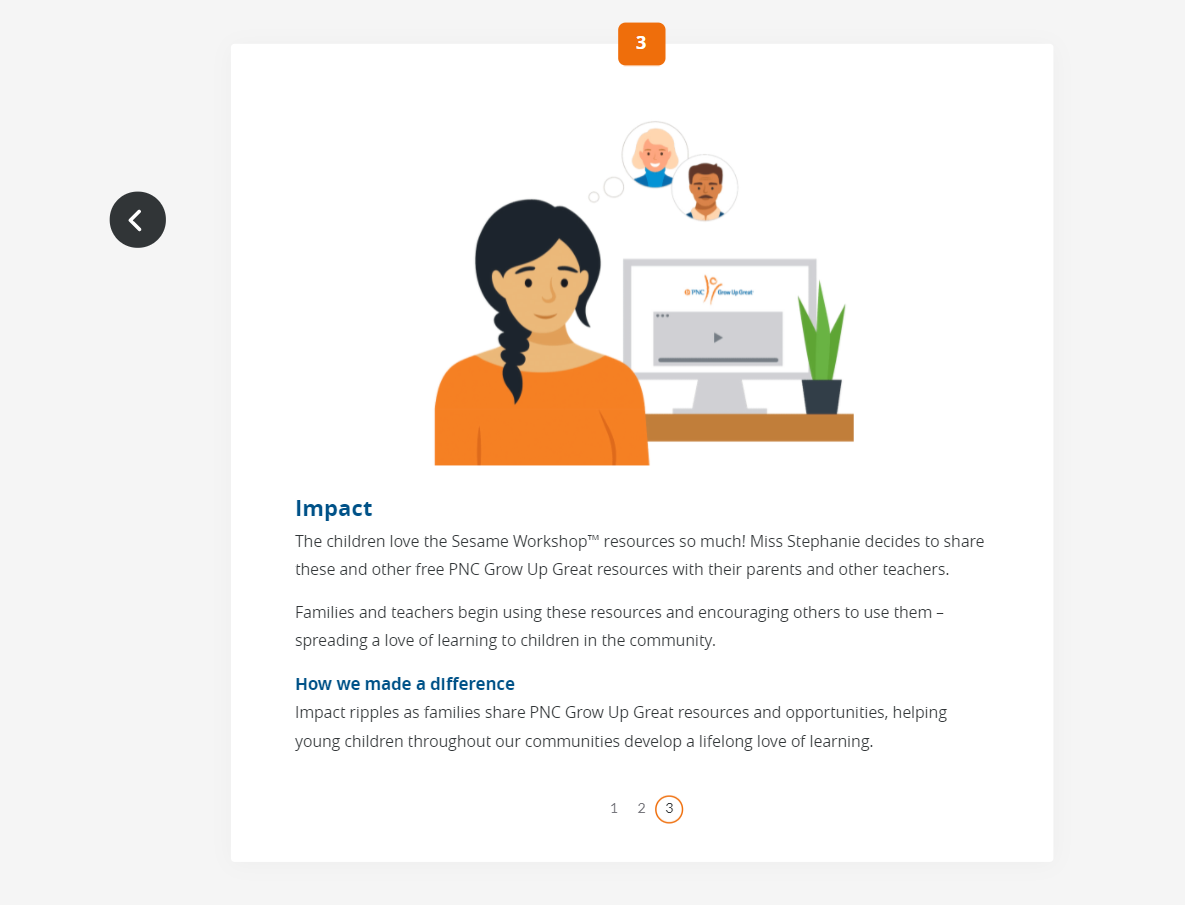

Past the course experience, we provided a natural user experience to cement learning via the option to download appropriately translated digital course worksheets which were featured as interactive sections in the course and the option to visit the Personal Finance Insights Hub where they can find more resources (in English or Spanish) to further their financial education.

PNC Bank Employee eLearning Experience

Developed an end-to-end internal employee eLearning which exceeded completion goals by 9%.

As a result our employees understood our new brand purpose and its role in their work across silos.

Background: PNC’s brand purpose strategically guides all of the work its employees create, manage and plan. An understanding of the new brand purpose by all employees was necessary to build a cohesive experience across the bank.

Users: All PNC employees, internal and external-facing, people managers and individual contributors, across all departments and physical locations.

Problem: To ensure a cohesive user experience enterprise-wide, completion of the introductory eLearning course was necessary, but employee’s relation to the brand purpose varied widely across job descriptions as did their job limitations and the course couldn’t be rated “mandatory” to promote completion.

How would we get employees to engage in learning and absorb the content so it guided their work?

Feedback: 1. Certain roles at the bank only allowed for employees to be away from their station for < 15 minutes at a time. 2. The majority of roles at the bank were not related to branding, marketing strategy or advertising so the content needed to resonate across silos. 3. Unless the eLearning was “mandatory”, we might see low engagement and completion rates since employees are focused on critical job-related tasks.

Solution: Create a <15 minute eLearning experience to introduce PNC’s new brand purpose through broad, informative, and interactive examples that resonate with all employees and provide incentives for completion via larger enterprise-wide recognition and reward programs.

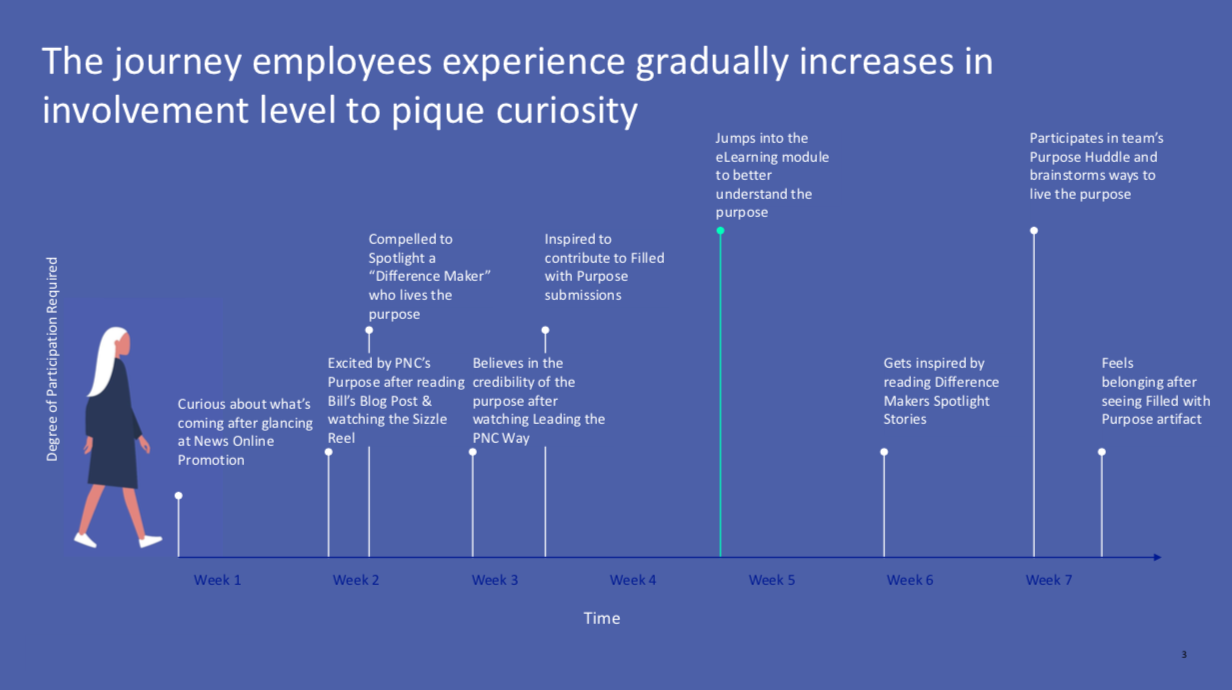

Other Considerations: The eLearning was part of a larger brand purpose experience which was designed with the employees’ perspective at the center by piquing curiosity, sharing information and then providing opportunities to engage via the eLearning. The experience design made use of natural curiosity to serve as an intrinsic catalyst for course

Timeline: December 2021-May 2022

The experience design made use of natural curiosity to serve as an intrinsic catalyst for course engagement and completion.